The Big Mistake Celebrities Make When Estate Planning

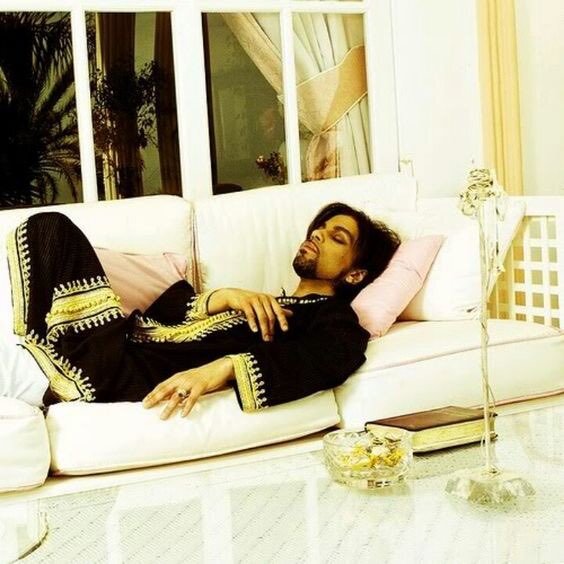

[vc_row][vc_column][vc_column_text]Celebrities and millionaires are people, too! Everyone now knows that one of my favorite musicians of all time, Prince, died without a will and his estate is now subject to intestacy laws. This very private person’s life will now become very public. I wonder about the status of Paisley Park…will it be a museum or memorial? Would Prince have wanted to sell tickets to see his home? Will estate taxes dictate the sale of his personal property?His story is another timely reminder that nearly everyone thinks they will live a long time. Can you or your clients (athletes, entertainers, and even UHNW) learn from his mistakes? It’s not just the will process, but the philanthropy and legacy process, to consider in some cases.Prince's lack of estate planning highlights a common mistake made by many estate planners: The busiest, least accessible, most important clients (entrepreneurs, hedge-funders, actors, athletes and celebrities) are just like everyone else and have the same basic estate planning needs. In real life, they are not like everyone else! Indeed, a very rich client can have as much as 20% of their net worth in personal property.

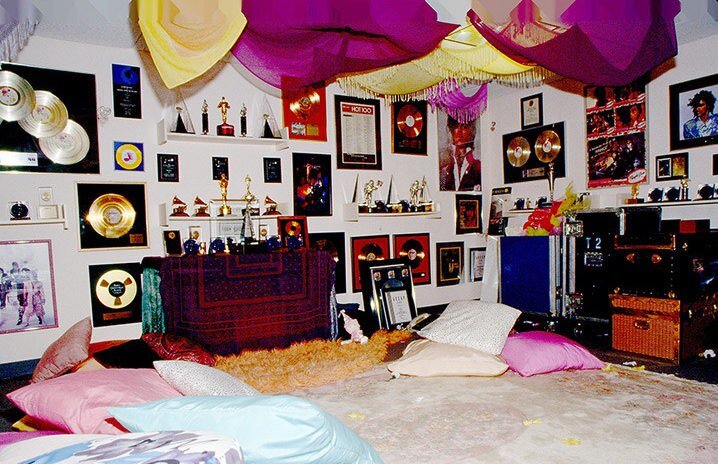

Everyone now knows that one of my favorite musicians of all time, Prince, died without a will and his estate is now subject to intestacy laws. This very private person’s life will now become very public. I wonder about the status of Paisley Park…will it be a museum or memorial? Would Prince have wanted to sell tickets to see his home? Will estate taxes dictate the sale of his personal property?His story is another timely reminder that nearly everyone thinks they will live a long time. Can you or your clients (athletes, entertainers, and even UHNW) learn from his mistakes? It’s not just the will process, but the philanthropy and legacy process, to consider in some cases.Prince's lack of estate planning highlights a common mistake made by many estate planners: The busiest, least accessible, most important clients (entrepreneurs, hedge-funders, actors, athletes and celebrities) are just like everyone else and have the same basic estate planning needs. In real life, they are not like everyone else! Indeed, a very rich client can have as much as 20% of their net worth in personal property. Personal property assets, such as art, antiques, jewelry, wine, cars, boats, and luxury items are an asset class unto themselves. Yet, many wealthy individuals neglect to manage and protect their treasures as conscientiously as they manage their career, financial or business investments. Surprisingly, some even neglect to insure their collections, often because they just don't get around to it. Others are very private individuals who want no record of their collections.But that's a mistake. The estate planner, attorney or accountant should advise their most affluent clients to privately document and record everything, including their wishes.Collections are more complicated to value and should be addressed early in the process by inventorying and appraising. From there, the planning can ensue. Otherwise, unintended consequences may one day follow, such as selling objects in order to pay an estate tax, or dealing with unacceptable donations or undesirable inheritances.Traditional estate planning is usually insufficient to handle “celebrity” needs and goals. A more holistic approach to the planning of life and death is legacy planning. Legacy planning involves the management of total wealth while alive, and distributing estate assets how you choose after your death, including the legacy of your chosen philanthropy. Often a reminder like “Your nasty niece may end up with your Hermes bags and your attentive nephew might not get your record collection” can motivate a client to hire an appraiser to create an inventory at the very least.As tax season approaches, you’re likely to have conversations with clients soon. It’s time to put Legacy Planning on the agenda (with a nod toward your favorite unbiased appraiser of tangibles). You will also probably have to sit down with your own accountant to handle your own affairs. It will be time well spent.For Help with Estate Planning, Legacy Planning or Will Preparation this Tax Season, Contact Lynn Magnusson at Info@TheMagnussonGroup.com or (973) 425-1550[/vc_column_text][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]For more information on Prince's estate, read the article that inspired Lynn's blog:Why Artists Like Prince Need a Legacy Plan Not an Estate Plan

Personal property assets, such as art, antiques, jewelry, wine, cars, boats, and luxury items are an asset class unto themselves. Yet, many wealthy individuals neglect to manage and protect their treasures as conscientiously as they manage their career, financial or business investments. Surprisingly, some even neglect to insure their collections, often because they just don't get around to it. Others are very private individuals who want no record of their collections.But that's a mistake. The estate planner, attorney or accountant should advise their most affluent clients to privately document and record everything, including their wishes.Collections are more complicated to value and should be addressed early in the process by inventorying and appraising. From there, the planning can ensue. Otherwise, unintended consequences may one day follow, such as selling objects in order to pay an estate tax, or dealing with unacceptable donations or undesirable inheritances.Traditional estate planning is usually insufficient to handle “celebrity” needs and goals. A more holistic approach to the planning of life and death is legacy planning. Legacy planning involves the management of total wealth while alive, and distributing estate assets how you choose after your death, including the legacy of your chosen philanthropy. Often a reminder like “Your nasty niece may end up with your Hermes bags and your attentive nephew might not get your record collection” can motivate a client to hire an appraiser to create an inventory at the very least.As tax season approaches, you’re likely to have conversations with clients soon. It’s time to put Legacy Planning on the agenda (with a nod toward your favorite unbiased appraiser of tangibles). You will also probably have to sit down with your own accountant to handle your own affairs. It will be time well spent.For Help with Estate Planning, Legacy Planning or Will Preparation this Tax Season, Contact Lynn Magnusson at Info@TheMagnussonGroup.com or (973) 425-1550[/vc_column_text][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]For more information on Prince's estate, read the article that inspired Lynn's blog:Why Artists Like Prince Need a Legacy Plan Not an Estate Plan

Co-Authors: Lynn Magnusson, ASA, AAA and Becky Lipnick, Communications Coordinator[/vc_column_text][/vc_column][/vc_row]